24 Apr Australian Business Economic Impact Survey (ABEIS): Week 4 – Industry insights

Following the launch of the Australian Business Economic Impact Survey (ABEIS) we published the first national level findings on April 3rd. As responses increased, state level insights were presented on April 14th, and in this article we shift the focus to the impacts of COVID-19 for industry sectors.

The survey results are showing that businesses in the arts & recreation sector are the hardest hit by the COVID-19 crisis, reporting the highest revenue losses of any industry. Average impact on revenue being reported by arts & recreation businesses is -55.7 percent, greater than accommodation and food services (-49.3 percent) and other services (-46.5 percent).

Staff and revenue impacts by industry

Individual industries are experiencing the effects of the COVID-19 crisis to varying degrees. ‘Frontline’ population serving industries, such as those mentioned above, are topping the list of those businesses with highest average revenue losses.

As we mentioned in a previous blog, there is evidence of divergence between revenue and staffing. That is, businesses are seeing much larger impacts on revenue than they are on staffing. From an industry perspective, this is most pronounced in the rental, hiring & real estate services sector, and the health care & social assistance sector, both of which are reporting 27 percent difference between impacts on revenue compared to staffing.

Figure 1 Impact on revenue and staffing, selected industries (sort columns by clicking on the heading)

Business confidence

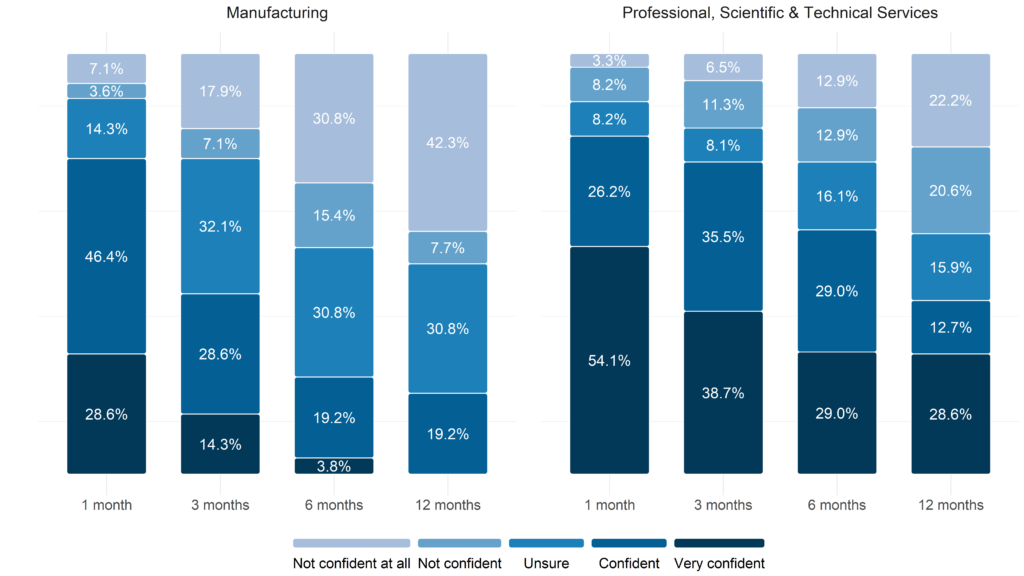

Some industries are demonstrating a higher degree of confidence about business viability over the coming year than others. Comparing the sentiments of businesses in manufacturing and professional services, we can see that confidence in the viability of professional service businesses is maintained at a relatively high level. By comparison, the confidence of businesses in manufacturing begins to decline notably at every three month interval.

Figure 2 Confidence in business viability, selected industries

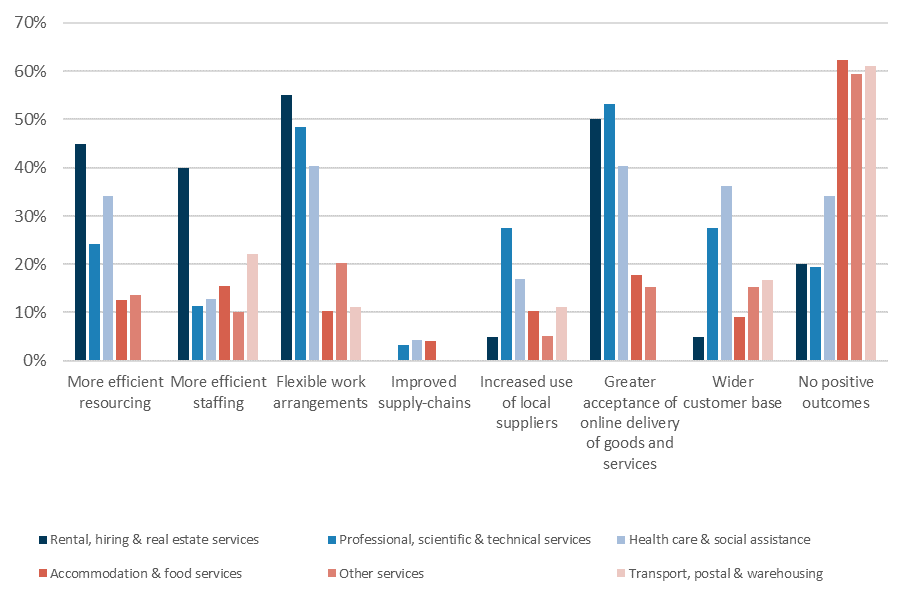

Operational benefits by industry

While the effects of COVID-19 are predominantly negative for businesses, there are some that are seeing positive operational changes. These include greater customer acceptance of online delivery of services, increased use of local suppliers, and more flexible work arrangements.

Businesses which are reporting the higher proportion of positive outcomes are in industries such as rental, hiring & real estate services, professional, scientific & technical services, and health care and social assistance.

However, there are industries where these positive outcomes are less apparent. Around 60% of respondents in accommodation & food services, other services (which includes businesses in personal services) and transport, postal & warehousing are seeing no positive operational changes as a result of the crisis.

The chart below illustrates the responses of the top three industries (in blue) reporting more positive outcomes, compared to the three industries (in red) with the highest proportion of responses indicating that there have been no positive outcomes.

Figure 3 Extent of positive outcomes of the COVID crisis, selected industries

About the survey

The survey will be open for at least the duration of the COVID-19 crisis. Businesses will be encouraged to respond several times throughout the crisis as policy and circumstances change.

REMPLAN is taking snapshots of the survey results on a weekly and monthly basis, which will enable time series analysis and monitoring of the changing impacts and sentiments from businesses over time.

Monthly reporting with unidentified results at an industry level (i.e. reporting for retail trade, manufacturing, etc), will be made publicly available on our website.

All councils and Australian government agencies are able to receive an excel file with unidentified survey response data. This will include a summary of all results for the Nation, your State or Territory, and depending on the number of responses, for your region. The survey data will also be formatted to allow the findings to be applied to REMPLAN software for economic impact modelling.

We welcome your support in disseminating this survey within your own network of local businesses.

Survey link: remplan.co/C-19

Click the button below to take the survey

Let’s Talk: 1300 737 443.

Kind Regards,

The REMPLAN team

ABEIS COVID-19 Staff and Revenue Impacts by Industry (REMPLAN) – Cumberland Business Chamber

Posted at 05:20h, 10 May[…] Take the survey below or form more insights from the Survey: https://www.remplan.com.au/blog/2020/04/australian-business-economic-impact-survey-abeis-week-4-indu… […]

Finding the ‘New Normal’ for Transport & Distribution in Greater Western Sydney – Cumberland Business Chamber

Posted at 23:03h, 30 August[…] to changing consumer demand & purchasing behaviours in the last two decades, according to the recent ABEIS survey conducted by REMPLAN around 60% of sector respondents believed there are no positive outcomes to be […]