14 Apr Australian Business Economic Impact Survey (ABEIS): Week 2 – Updated Insights

Thank you to all the organisations that have been communicating and disseminating the Australian Business Economic Impact Survey (ABEIS), and also to the responding businesses which are providing valuable insights.

While it is self-evident that COVID-19 is having a significant impact on Australia, there is nevertheless considerable variation across industry sectors and regions. These industry and region-specific insights are vital for understanding the support that our local businesses require now, and also in coming months when we transition to economic recovery and stimulus.

The situation we are in is fluid and if your local businesses have responded to the ABEIS, please ask them to respond again in coming weeks, and again in coming months. The ABEIS will remain live for as long as the crisis continues and it is important to record businesses’ experiences to date, and their sentiments about the future.

Click the button below to take the survey

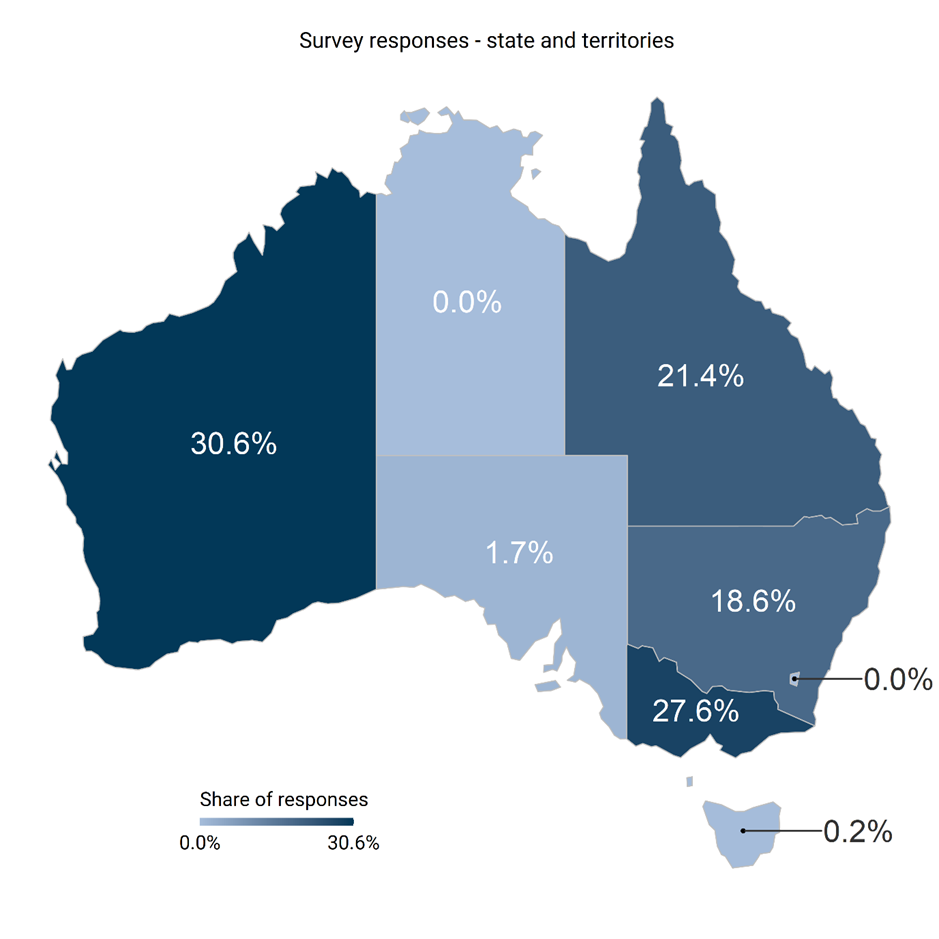

On the third of April we published early insights from the ABEIS at a national level. Since then there have been significantly more responses and we are now able to provide state level insights.

Queensland has seen the largest increase in responses, up from 4.9 percent last week to 21.4 percent of all responses this week. Victoria has also seen a jump in the relative number of responses compared to other states and territories.

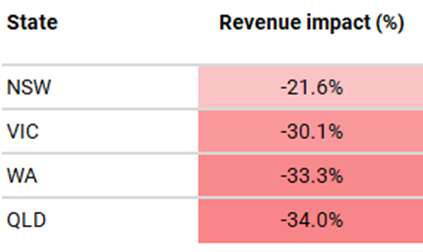

Of the four states with the largest proportion of responses, businesses in New South Wales are reporting the lowest average impact on revenue at –21.6 percent. By contrast, businesses in Queensland are indicating an average decrease in revenue of -34.0 percent.

Average revenue impacts

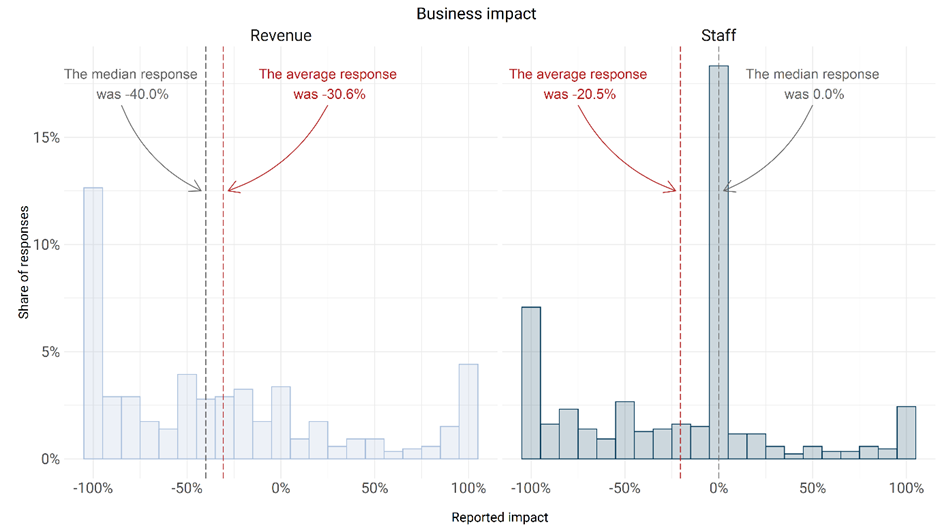

Analysis of business responses from all industries across the nation indicate that the negative impacts of COVID-19 in terms of revenue loss are much greater than the impacts on staffing levels. On average, businesses are reporting a decrease in staffing levels of -19 percent, while the average decrease in revenue is estimated at -28 percent.

It is likely that these findings reflect the Government’s JobSeeker, JobKeeper and other initiatives to support employment and consumption levels in the context of significantly lower demand.

The median response (i.e. the midpoint of all responses) for staffing was 0 percent, or no change. In contrast, the median response for revenue was -40 percent. Again, this suggests that to date the negative impacts on businesses are being felt on the bottom line.

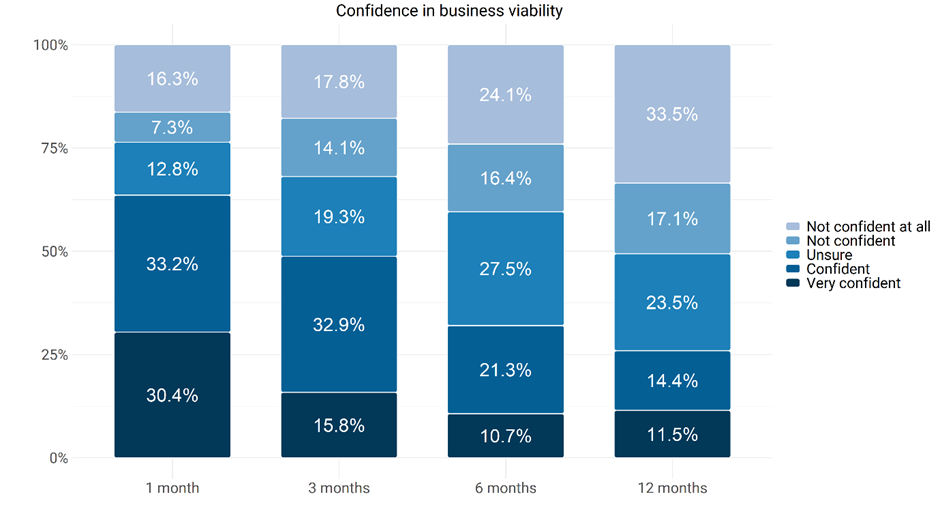

Business confidence

Almost two thirds of respondents have a positive outlook (are confident or very confident) in the short term, indicating their business would still be viable in one month’s time.

This confidence decreases substantially when casting out three, six and twelve months in the future. In twelve months’ time if current restrictions continue, only 25.9 percent of respondents have a positive outlook for their businesses’ viability.

About the survey

The survey will be open for at least the duration of the COVID-19 crisis. Businesses will be encouraged to respond several times throughout this period as policy and circumstances change.

REMPLAN is taking snapshots of the survey results on a weekly and monthly basis, which will enable time series analysis and monitoring of the changing impacts and sentiments from businesses over time.

Monthly reporting with unidentified results at an industry level (i.e. reporting for retail trade, manufacturing, etc), will be made publicly available on our website.

All councils and Australian government agencies will be able to receive an Excel file with detailed unidentified survey response data. This will include a summary of all results for the Nation, your State or Territory, and depending on the number of responses, for your region. The survey data will also be formatted to allow the findings to be applied to REMPLAN software for economic impact modelling.

We welcome your support in disseminating this survey within your own network of local businesses.

Survey link: remplan.co/C-19

Kind regards,

The REMPLAN team

REMPLAN | Australian Business Economic Impact Survey (ABEIS): Week 4 – Industry insights | REMPLAN

Posted at 03:43h, 24 April[…] we mentioned in a previous blog, there is evidence of divergence between revenue and staffing. That is, businesses are seeing much […]